‘If only’ is something traders say a lot.

If only I had the perfect entry and exit system.

If only I had put more size on.

If only I would have held on a bit longer.

If only I had followed what my gut said.

If only ….. (You fill in the gap).

Were ‘If only’, and it’s sibling ‘Should have’, represented as small notes of paper, you could wade knee-deep through them on the floor of any trading room.

‘If only’ and ‘Should have’ represent the battle each trader has with themselves as they seek to navigate the uncertainty of financial markets.

For you as a trader or investor to succeed, it’s not the markets you have to overcome, it’s yourself.

‘It’s Not The Markets You Have to Overcome, It’s Yourself’.

To The Victors Belong the Spoils.

An extensive research paper* found that whilst about 20% of traders make money in a typical year, they also found that it was not the same 20% every year.

The real success rate, those traders who achieved continued and sustainable success over many years, was actually closer to just 1%.

And even then, only a small portion of that 1% achieved extraordinary outperformance: Otherwise known as ‘smashing it’.

In this sense trading is no different to other fields of performance.

In sport, only a small number get to play at the very highest level, even though many will reach a very good standard.

Sport provides a great analogy to trading. – The biggest enemy for any sports player is not lack of technical ability, the real enemy is the enemy within.

During my trading years, I use to keep the following ‘Babe Ruth’ quote visible on my desk. ‘Never let fear of striking out, keep you from playing the game’.

This quote sums up the mental challenge of trading, as much as it summed up the mental challenge Babe Ruth faced when he stepped up to bat.

It emphasises the real challenge ‘Winning the Inner Game’.

Winning the ‘Inner Game’.

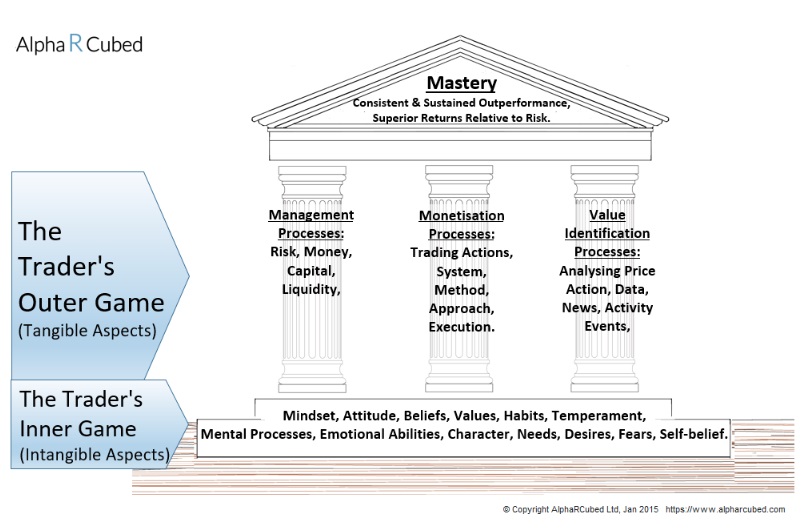

The image below highlights the ‘Inner Game’ as the Foundation which the Outer Game rests on.

I shared my own journey on developing my Inner Game as a trader in an article titled ‘What is Behavioural Trading?’

In that article I described my own awakening as a trader after going through a coaching programme and experiencing the huge impact this had on my performance.

I now see many of my own clients go through a similar awakening and transformation as traders.

Developing the Outer Game, the tangible aspects of trading and investment performance, is relatively easy. It may not happen overnight, but in time and with good mentoring, one can become reasonably competent in these areas.

Becoming competent technically may mean you survive for a time, as I did. But somewhere along the line you need to become good.

Even then, being good is still is not ‘good enough’. To truly succeed you need to learn to become ‘excel’.

Only the very good make it into the top 1%, and only the truly excellent become the small percentage of that group that ‘smash it’.

Becoming very good comes from developing ‘Behavioural Mastery’: Behavioural Mastery includes emotional intelligence, decision-making abilities, resilience, congruence between personal stance and risk approach, reigning in your ego, and a host of related factors.

The sages of Financial Markets recognise this. – Warren Buffett said “You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.” He went on to say that ‘The key to success is emotional stability‘.

‘The key to success is emotional stability’. – Warren Buffett.

Learning About Yourself.

During the first half of my trading career, I spent much time searching for that elusive technical edge, perfect system, or secret signal that I believed would help me excel. That search only lead to marginal improvements at best.

What really helped me to make the big transition to a higher level was learning about myself, with a coach as a guide on that journey.

Leaning about myself involved learning who I was, how I was, how I was impacted by risk and uncertainty. It involved understanding how my interactions with the environment influenced how I behaved. and becoming more conscious of my style and how it could provide an edge, and what parts of myself sought to sabotage me. – That was the catalyst for what lead to a huge improvement in my trading.

We spend so much time looking outside of ourselves, that we miss what is in inside of ourselves.

There is a great quote taken from the ancient Chinese general and philosopher Sun Tzu in his book ‘The Art of War’.

If you know your enemies and know yourself, you will not be put at risk even in a hundred battles.

If you only know yourself, but not your opponent, you may win or may lose.

If you know neither yourself nor your enemy, you will always endanger yourself.

Getting to ‘Know Yourself’ is something every trader should seek to engage in if they wish to succeed in the long-term.

It is why I firmly believe that your success as a trader or as an investor does not come from learning to beat the market, it comes from learning to beat yourself.

*The cross-section of speculator skill: Evidence from day trading: Barber, Lee, Liu, Odean: Journal of Financial Markets 18 (2014) https://www.sciencedirect.com/science/article/abs/pii/S1386418113000190